The Five Major Real Estate Crashes Since WWII

A financial crisis can come from many different sources, almost all of which involve a system or a government that borrowed more money than it could pay back. The news that some debts can’t be repaid is sometimes a surprise, but the aftermath is predictable—someone, somewhere, will end up getting stuck with the bill. It’s often the taxpayers.

These issues are well-documented in what is probably the most popular book on the subject, This Time is Different: Eight Centuries of Financial Folly, by Carmen Reinhart and Kenneth Rogoff. Using over 800 years of financial data, the book is mostly focused on historical sovereign debt (that’s where the most data is available) and the 2008 crisis (the most recent major one).

What we’re interested in are asset bubbles, specifically real estate asset bubbles, because real estate prices create a more powerful and long-lasting shock to the system—and two of the top five largest asset bubbles in history were real estate bubbles.

According to Reinhart and Rogoff, real estate is one of the best warning signs that an economy is about to have a banking crisis: it starts with a credit boom, usually fueled by low interest rates; the credit boom leads to an asset price boom, which becomes a bubble when prices outstrip values; when the housing prices hit their peak, a banking crisis will happen within about one year of that peak, and the stock market will go down with the banks. On average, when the crisis hits, real housing prices are cut in half over a period of four to six years.

Using their data, we marked the five major real estate crashes since WWII:

| Major Real Estate Crashes Since WWII | Year of Peak Housing Prices | Year of Banking Crisis |

| Spain | 1978 | 1977 |

| The Norwegian Banking Crisis | 1987-1990 | 1987-1991 |

| Japan | 1991 | 1992 |

| Asian Financial Crisis | 1994-1997 | 1997 |

| US Subprime Meltdown | 2005-2007 | 2007-2008 |

It’s always hard to see what’s happening when prices are rising—are we looking at a bubble or just a strong boom? So, other than just talking about how easily we can see a bubble in hindsight, we’re also looking at what happens after the crash. We want to see if there is a consistent theme that determines which countries recover quickly and which countries continue to struggle. Under the wrong conditions, the collapse of an asset bubble can take decades to unwind.

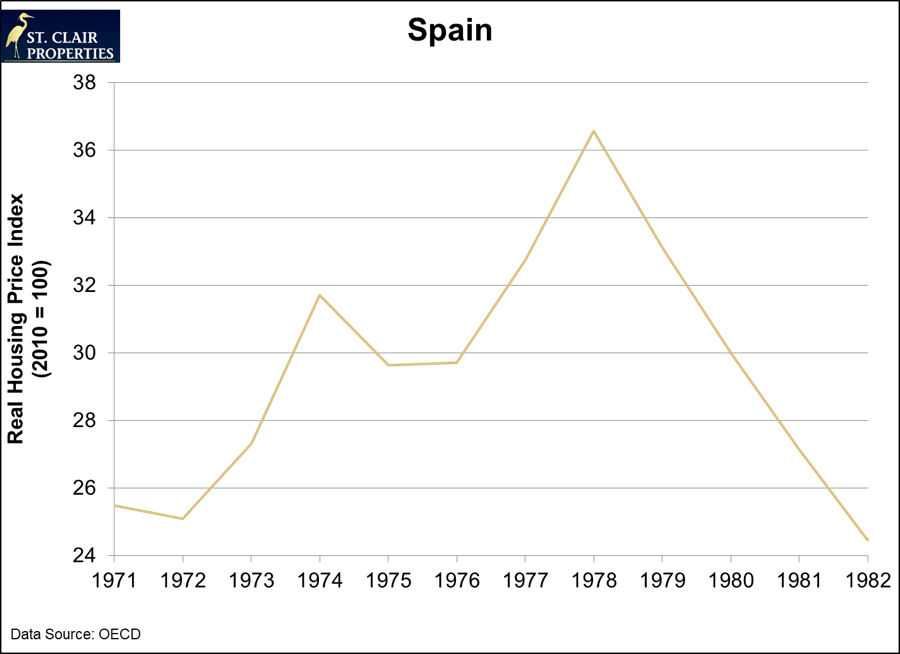

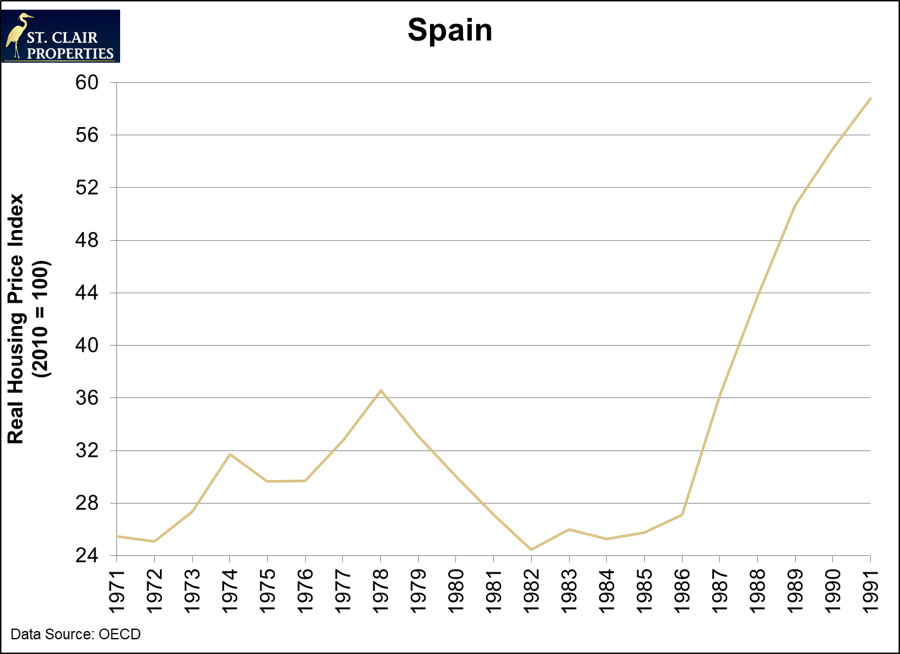

Spain’s Growing Pains (1977)

Spain is unique in this list of countries because it was ruled by a dictator until 1975, and its banking crisis wasn’t entirely caused by a housing bubble. The emerging democracy was crippled by an economy that imported 70% of its oil and could not cope with the global oil shocks of the 1970s.

By 1982, the country (and its housing prices) hit rock bottom. Inflation was raging and government spending was out of control.

The 1982 elections brought in a wave of pragmatic socialist politicians. Their solution followed the standard economic advice: cut unnecessary public spending; reorganize inefficient government programs; shut down ineffective government-run industries; and provide long-term economic plans to attract foreign investors.

It worked. By 1985, the country’s budget deficit was only 5% of GNP. Over the next decade, Spain’s economy, and its housing prices, made a tremendous recovery. With an extra boost from foreign investment and lower oil prices, Spain was the fastest-growing OECD country in 1987.

Spain’s 1982 economic reorganization is credited as a major reason for the country’s remarkable rise in the late 1980s. However, some of these lessons may need to be re-learned, because Spain was one of the primary victims of the latest financial crisis, and its recovery so far has been slow.

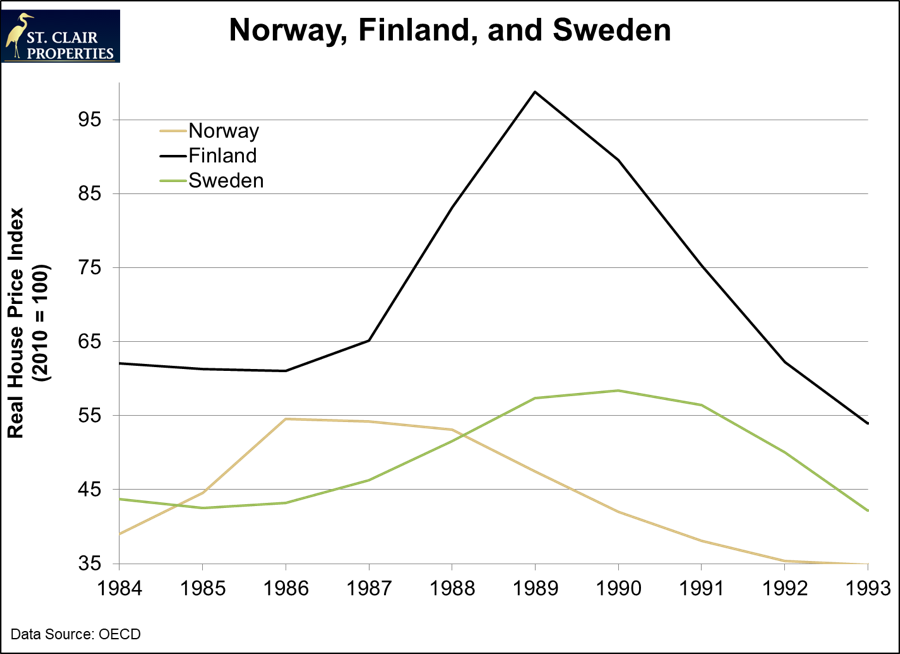

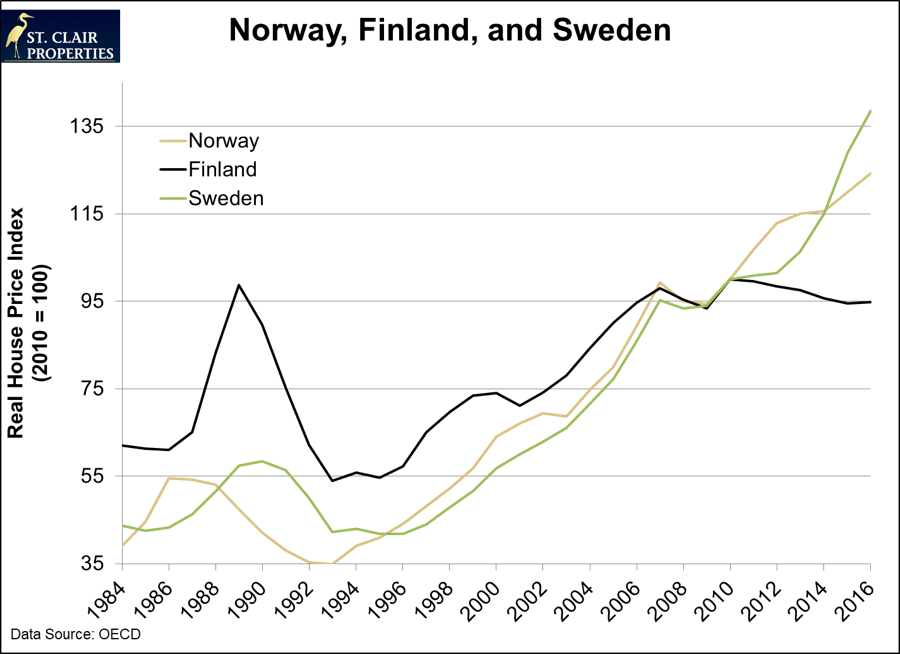

The Norwegian Banking Crisis: Norway (1987), Finland (1991), and Sweden (1991)

The Norwegian countries suffered a series of banking failures that dragged on from 1987 and exploded into a crisis that lasted through 1992. The trigger for this crisis is usually attributed to the high interest rates and turbulent foreign exchange market that came with the reunification of Germany in 1990. These global market changes destabilized the fixed currencies and generated a regional currency crisis.

The Nordic bubble started, predictably, with a massive push for banking deregulation. Norway went first, in 1984, by removing lending caps and allowing its banks to make more risky loans. This led to a massive credit boom as the banks expanded their lending and competed aggressively, lending money for properties at continually inflated prices. Real estate speculation was widespread.

Finland and Sweden, watching how fast Norway was growing, instituted their own banking reforms. The effects were the same. All three countries saw extraordinary lending growth.

Norway’s government, sensing problems in its banking system, tried to tap the brakes on its growth. But it was too late. Norway was the first housing market to reach a top in 1987, followed by Finland in 1989 and Sweden in 1990.

All three countries started their bank bailout procedures. At first, when only the small banks were failing, they were simply merged with larger banks. Eventually, even these larger banks began to fail, and they were quickly injected with bailout money and generous loans from the government. The banks were also required to raise their lending standards.

The economic and housing recovery for all three countries was swift, and it continues up to the most recent data.

The Norwegian countries have had such large growth in their housing prices that some investors are warning about another bubble in the region. Norway’s home prices grew by 12.4% over the past year (its fastest growth ever), while Sweden’s prices rose by 9%.

Sweden and Norway are both desperately trying to contain the new housing boom (or is it a bubble?)—both countries have put limits on borrowing that don’t seem to be slowing the price growth.

The problem is that both countries, worried about slow global growth, have record low interest rates. With Norway at 0.5% and Sweden at negative 0.5%, a credit boom, and a corresponding asset boom, is inevitable. With the amount of debt floating around the region, this will be one to watch.

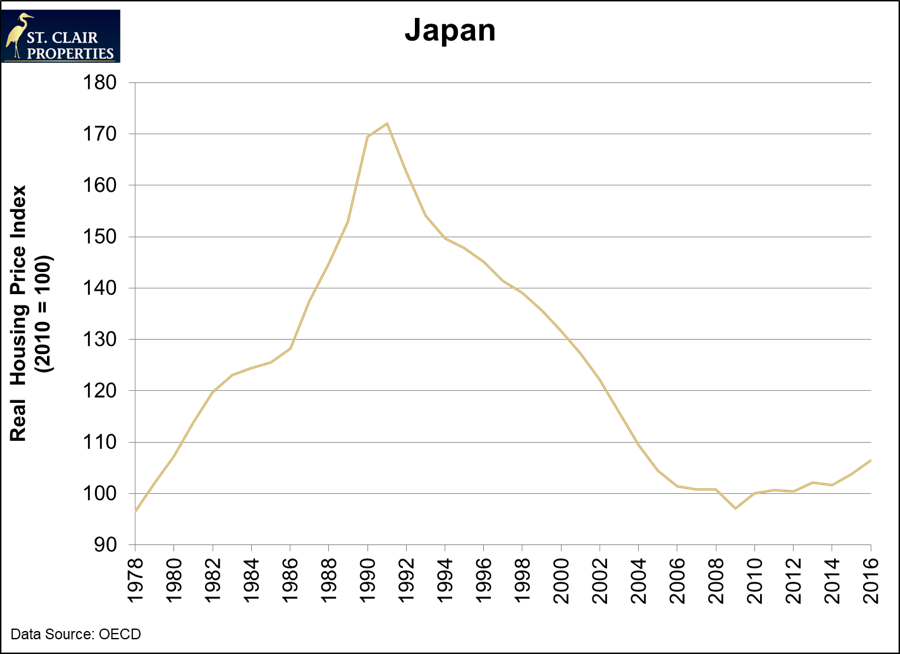

Japan’s Lost Decades (1992)

Japan holds the distinction of having the largest housing bubble in history. At one point in 1989, the country’s Imperial Palace grounds were worth more than all of the real estate in California. That’s a bubble!

Japan’s real estate bubble started in the same way that other bubbles begin—with a massive credit boom. This boom was kickstarted when the Bank of Japan began dramatically lowering interest rates in 1986—from 5% down to 2.5%—to help the country recover from a short recession and a strong yen. By this time, land prices were already rising, but the central bank’s stimulus accelerated the boom, leading to urban land values (especially in Tokyo) that tripled in just four years.

The central bank, concerned about a housing and stock market that were both rocketing out of control, began to raise interest rates again in 1989 and 1990.

It was too late. The bubble exploded more catastrophically than any other housing bubble ever has, but it only affected Japan—the period after Japan’s 1992 crisis is now known as the “lost decade” because the country deflated through the 1990s while the rest of the world boomed.

The decline lasted so long that real housing prices didn’t stabilize until 2009, and they’ve remained stagnant up to the latest available data. Japan is now in the middle of its third lost decade in a row and, so far, the government and central bank have been unable to pump the economy back up.

Japan is a special case. Unlike the aftermath of other housing crashes, Japan didn’t make any changes to the way its banks do business. Japan’s government bailed out the banks, but the lending standards didn’t change. The funds were used to loan money to companies that already couldn’t pay their debts.

After decades of fighting the deflationary trend, a new Prime Minister, Shinzo Abe, was elected to office in 2012 on a “three arrows” plan, known as Abenomics, that was determined to crush Japan’s deflation.

The three arrows involve a combination of zero-interest-rate monetary policy, tax cuts, and structural economic reform. Taken together, the policy is a good one, but it hasn’t been politically popular. The Bank of Japan did its part, taking interest rates as low as it could possibly go (even into the negatives), but the Japanese government actually raised taxes and refused to consider any structural economic changes.

Japan is already starting to struggle with an aging population that is expected to start shrinking (creating even more deflationary pressure), but the country won’t be able to make a solid recovery until it’s willing to consider some badly needed economic reforms. Until then, the country’s debt-to-GDP ratio of over 200% keeps the whole system dangerously close to the edge of another collapse.

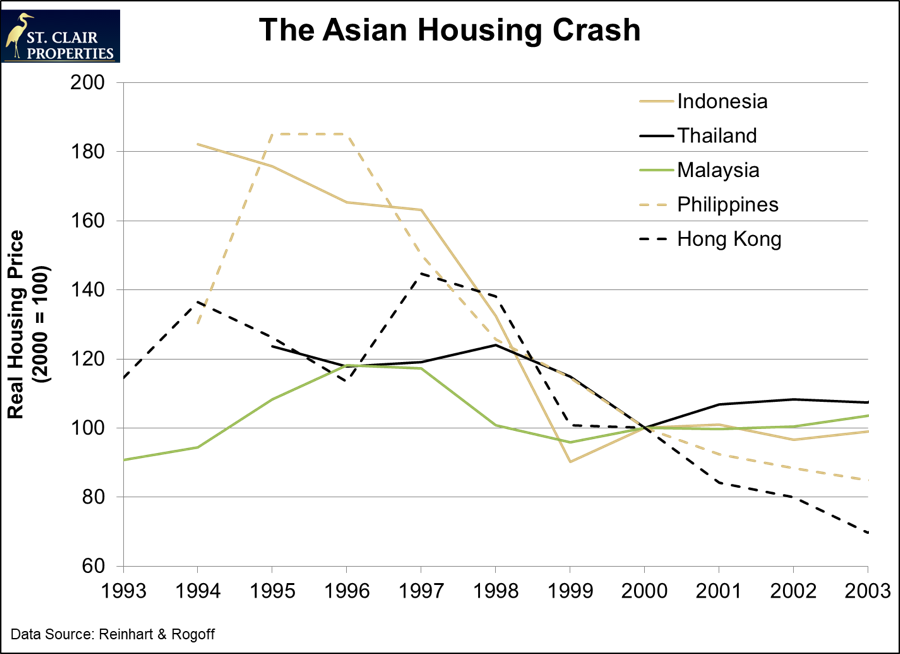

Asian Financial Crisis (1997)

The Asian Financial Crisis is officially a currency crisis, but it’s included in our list of real estate bubbles because the boom leading up to the crisis was accompanied by several real estate bubbles, and the currency crash came with a painful real estate market crash.

It started the same way that all housing bubbles begin—with years of cheap credit that encouraged bad loans. It was pumped up by huge amounts of foreign investment, which strained the Southeast Asian currencies that were pegged to the US Dollar. When the Federal Reserve began to raise interest rates, the foreign investment dried up.

Thailand was the first to fall. Under siege by currency speculators, the Thai baht dropped by 20% on July 2, 1997. Then the whole region’s foreign investors started pulling out.

The contagion quickly spread to Malaysia, then the Philippines, Singapore, and Indonesia. It eventually spread to the stronger economies, hitting Hong Kong, South Korea, and even Japan and China. By the end of 1998, even Russia and Brazil were caught up in a crisis. The situation was so critical that, starting in 1997, the International Monetary Fund and the World Bank stepped in with several rounds of bailout funding.

With support from the rest of the world’s banking systems, the crisis was contained, but the funding came with serious changes for the countries that accepted bailout loans: they were required to shut down their weakest banks, restructure the ones that had a chance to survive, and build much stronger banking regulations that ensured higher lending standards.

The bailout programs, along with carefully tuned central banking policies, were successful in stabilizing the affected countries. By the end of 1998, most of the Asian countries were returning to normal. By the end of 1999, they were growing as if nothing happened.

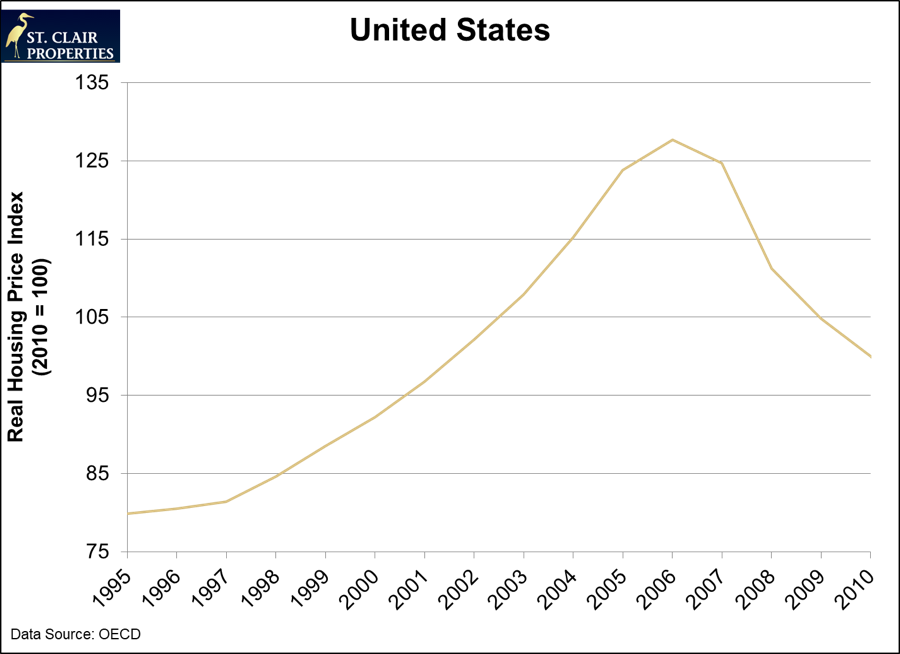

US Subprime Meltdown (2007-2008)

The US Subprime Meltdown, while considered the second largest housing crash in history, was the one with the largest worldwide impact. The interconnectedness of the market, and the amount of leverage built up inside it, had the potential to bring down entire global financial system.

It’s a long and complicated story, so here’s the short version.

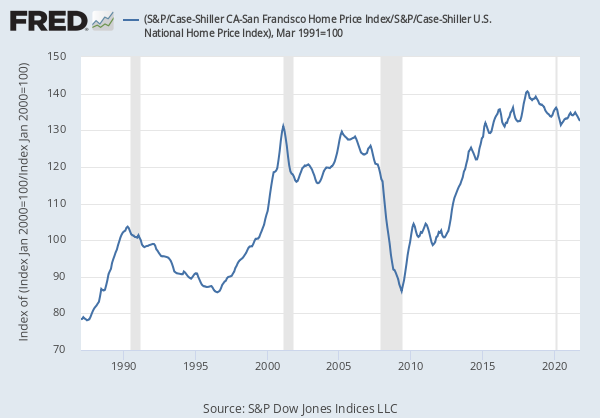

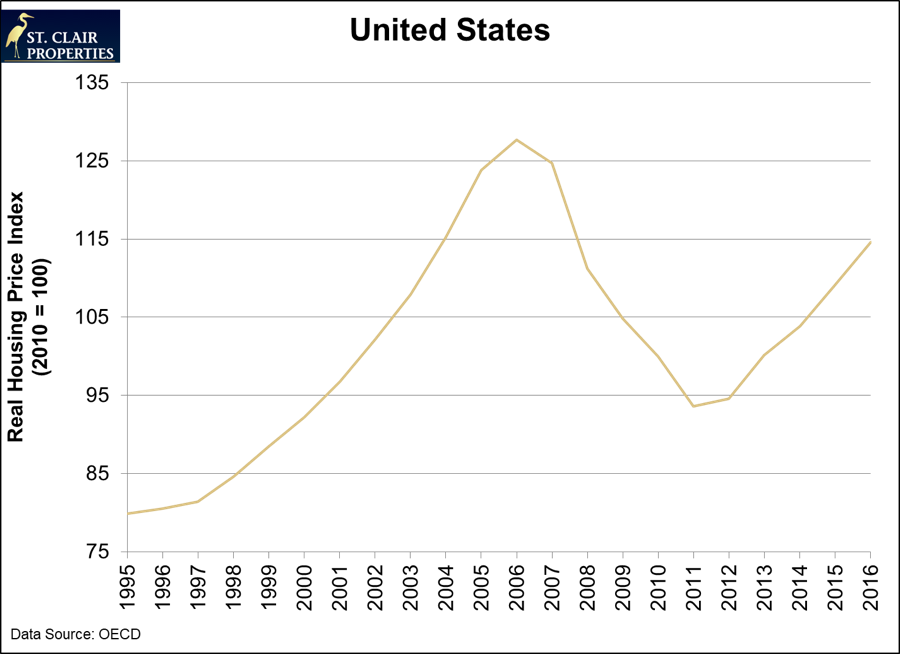

There were many housing bubbles throughout the world that all peaked within a few years of the US Subprime Meltdown, but the major one, and our focus here, is in the United States. It started with a sincere effort, in the mid-1990s, to encourage homeownership in the US, but it morphed into something more. The repeal of the Glass-Steagall Act in 1999, and the deterioration of regulatory oversight over the next few years, encouraged US financial institutions to make risky loans (known as subprime loans) and then make risky side bets on these subprime loans. The spread of these loans, and the spread of the bets on these loans, was accelerated by historically low interest rates of just under 2%. Housing prices ballooned out of control.

The whole thing started to collapse when housing prices began a gradual decline in 2006. At the time, it was considered a minor correction, but there was so much low quality debt that huge numbers of people were unable to pay their debts the banks—and the banks were unable to pay their debts to other banks. The boom in housing prices had been built on a fragile pile of debt.

A few bank failures trickled through the news in early 2008, but the system became completely overwhelmed in September and October, when Lehman Brothers failed and threatened to take down the rest of the country’s banks.

The Federal Reserve and the US Treasury Department acted quickly, securing $700 billion in bailout funds that were injected into the financial system. It took a couple years for the market to start its recovery, but the crisis was absorbed.

From 2008 to 2014, the Federal Reserve, in a program called “Quantitative Easing,” lowered interest rates to zero and continued to pump money into the financial system while the US government produced a series of stimulus programs. In an effort to prevent another major mortgage crisis, the US government passed the Dodd-Frank Act.

The US housing market has recovered nicely, and the stock market is currently in year eight of the second longest bull market ever. Lending standards remain tighter than they were during the housing bubble, and the US economy is on sound footing. However, political uncertainty (and economic gravity) has the potential to pull back some of the country’s recent growth. The scars are still healing.

Conclusion

A housing market boom is not unhealthy. It only becomes dangerous when it’s fueled by low-quality debt and excessive leverage. Those two features usually come from a combination of a central bank that holds interest rates too low for too long and a regulatory system that isn’t paying attention.

Even if a government recognizes the danger of an asset price bubble, it’s extraordinarily difficult to prevent it from catastrophically exploding. Norway and Japan both tried to keep their housing bubbles from getting out of control, but they were too late to prevent a big crash. The best defense, in this case, is a good offense. Strict lending standards and capital controls are necessary to prevent housing bubbles from getting too big to handle. In the aftermath, when it’s already too late, the countries that make the best recoveries are the ones that completely restructure their financial system. Even the former Federal Reserve Chairman Alan Greenspan eventually admitted that the banks can’t regulate themselves, and he spent his entire career trying to prove that they can.

The market always forgets what the last asset crash was like. This time is different, until it’s not. The best an investor can do is try to recognize when everyone else quits caring about value—when everyone else begins buying just to flip. They only look smart until they’re left holding the bag. The investors who have cash during a crash, and use it to buy cheap assets in the aftermath, are the ones who make the most money in the end.